Let me tell you about the biggest financial disaster you‘re going to see in your lifetime.

It could start as early as 2023, but we‘ll definitely see it play out over the next few years.

The US government finances itself in two ways. Through taxation and by issuing debt, typically in the form of treasuries and bonds.

(There‘s a third way the government robs from you, the individual: Inflation courtesy of the Federal Reserve - which is neither federal, nor a reserve. It‘s privately owned by its member banks and there‘s nothing backing its fiat currency, the dollar. “Fiat“ is a Latin word meaning determination by authority.)

At $23 trillion, the market for US sovereign debt is one of the largest in the world.

And it‘s a ticking time bomb.

With government bonds there are three main risks to your capital. You have the currency risk. There’s default risk because the debtor might go bankrupt. And you’ve got market risk. If rates rise, the value of your bonds goes down.

For a long time you couldn’t go wrong holding bonds. Rates were going down (and bond prices going up) for the last 40 years and even went into negative territory.

This trend clearly has ended and is headed the other way. In fact, interest rates have been going up faster than at any time in the entire history of interest rates, which spans thousands of years.

Right now, we‘re in an environment of rising interest rates. That‘s why bonds just had their worst year since the 1780s. And trillions of dollars in value have already evaporated for bond holders.

As rates go up, so do the government‘s interest expenses on its debt. The US is now paying almost $800 billion a year and is well on the way towards $1 trillion a year just in interest expenses. This doesn‘t include paying back even a single cent of the principal.

Let‘s face it. This debt is never going to be paid back. And that‘s why it‘s only a matter of time until the second major bond risk kicks in: Currency risk.

It‘s highly unlikely the US government will outright default on its bonds. The only way out is massive inflation.

No wonder almost nobody wants to buy US government bonds.

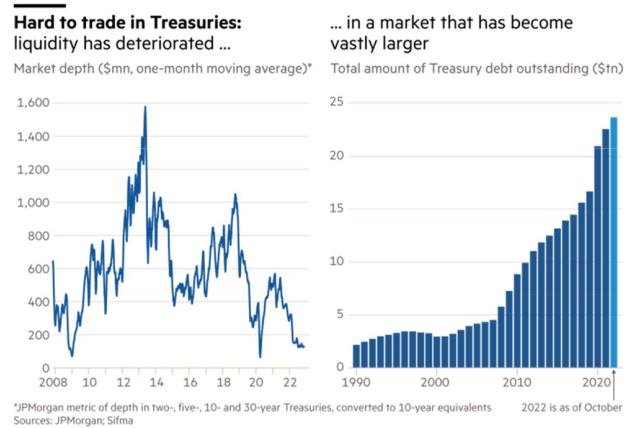

Liquidity is one important measure of how healthy a market is. And the US bond market is a dead man walking.

Even small orders of only a few hundred million dollars need to be broken down into smaller chunks and executed over the course of a day.

The bond market is an accident waiting to happen.

As you can see in the two charts above, liquidity has been declining to almost all-time lows, while the size of the market has soared to massive new highs.

In the much smaller UK bond market (called the gilts) we have already seen a smaller version of this bomb go off in October 2022.

Only heavy market intervention by the UK government stopped a complete implosion of the gilts.

It‘s not a matter of if this will happen in the US, the only question is when.

And let‘s not forget that the US simply confiscated Russia‘s treasury bonds worth hundreds of billions of dollars.

So governments around the world, especially the Chinese who hold $909 billion and Japan, who hold $1.078 trillion of these toxic papers, are heading for the exit.

Who in this macro environment is left to buy? Only the irresponsible, the mentally infirm and the insane.

Another major buyer used to be the Fed. But with Jerome Powell at the helm, the Federal Reserve has been on a tightening course and stopped buying US government bonds.

So now the US Treasury Department is already talking about buying back some of the most illiquid bonds to avoid a market meltdown.

A shock to the US bond market is only a matter of time.

A US bond collapse would have global consequences, ripping through stocks, corporate bonds and currencies.

And when it hits, the Fed has to step in. Just like in the UK, where the Bank of England stopped its quantitative tightening program to backstop the market.

The Fed will load the fiat confetti cannon and will shoot dollars into the market by buying US government bonds.

This will start the inflation cycle all over again and guarantees the final death of the dollar.

On the other hand, we have cryptocurrencies which offer a guaranteed maximum supply that cannot be manipulated at whim. Plus, cryptos offer true financial sovereignty without corrupt middle men.

So when the bond bomb goes BOOM, cryptos will shoot to the moon.

This video will show you how you can position yourself the right way and multiply your net worth in the years ahead.